Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

Sustainable investing has been part of our heritage for decades. Pioneer Fund, which dates back to 1928, is recognized as one of the first mutual funds to deploy socially responsible investment criteria1, avoiding companies in the alcohol, tobacco and gaming industries for much of its history.2 Today, we continue to extend our range of dedicated funds that are focused on Environmental, Social and Governance (ESG) components.

The research and investment processes we use at Amundi US are further supported by the extensive experience and global ESG resources of Amundi Asset Management.

|

|

|

|

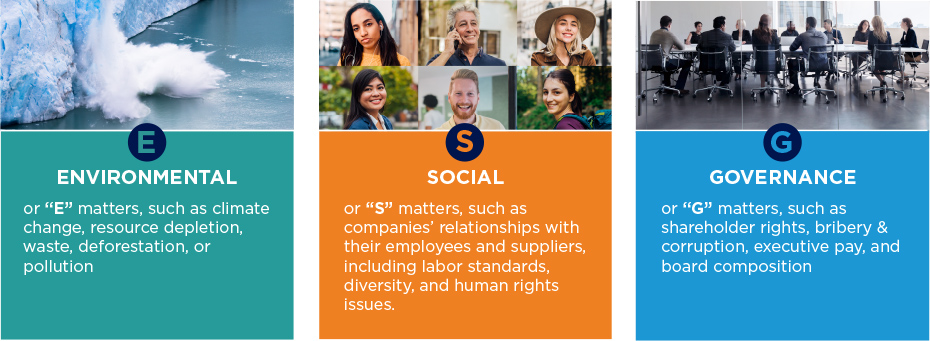

Steadfast commitment to ESGEnvironmental, Social and Governance (ESG) factors3, where available, are actively taken into consideration as part of the Amundi US investment research process used across many of our equity, multi-asset and fixed income portfolios. |

Allocated to Responsible InvestingWith more than €886 billion4 in ESG-related assets under management, Amundi continues to grow its global presence in responsible investment. |

Seeking Long-term Risk MitigationOur Portfolio Managers and Research Analysts construct portfolios that focus on sustainable business models and reducing ESG-related risks, supported by the Paris-based ESG research team. |

Our Portfolio Managers and Research Analysts Integrate ESG analysis into our investment process, where available, by focusing on companies with sustainable business models and evaluating ESG-related risks as part of the proprietary research recommendations we use throughout the firm. Environmental assessment categories typically include climate change, natural resource use, waste management and environmental opportunities. Social assessment categories typically include human capital, product safety and social opportunities. Governance assessment categories typically include corporate governance, business ethics and government and public policy.

1UBS Sustainable Investing. ”Adding Value(s) to Investing.” March 2015

2Until July 1, 2018, Pioneer Fund was not bound by such criteria in the prospectus.

3The investment process may incorporate ESG considerations in pursuit of a Fund’s investment strategy. These ESG considerations will vary across investment objectives and will not be the sole consideration in the investment process. Therefore, issuers within a portfolio may not be considered ESG-specific companies. The incorporation of ESG factors may limit exposure to some companies, industries or sectors and may mean forgoing some investment opportunities available to funds that do not consider ESG information or utilize a different methodology to assess ESG factors. Evaluations of ESG factors may vary by issuer and data providers and there is no guarantee that ESG considerations will enhance a Fund’s performance.

4Source: Amundi, data as of December 31, 2023.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2024-06-30-ADID-2976072-1Y