Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

Y-Share: FUNYX | A-Share: PIGFX

C-Share: FUNCX | K-Share: PFGKX

R-Share: PFGRX

The Fund seeks long-term capital growth by investing primarily in US large capitalization companies. We believe investing in quality stocks at attractive valuations can generate attractive risk-adjusted returns over time.

Overall Y Share Morningstar RatingTM(out of 1,111 funds in the Large Growth Category) |

Morningstar Sustainability RatingsTM

(out of 1,214 funds in the Large Growth Category |

Morningstar Proprietary Risk-Adjusted Ratings Performance as of 3/31/2024

Morningstar Sustainability Ratings as of 2/29/2024

For more information about Morningstar Star RatingsTM including methodology, visit our

Strength Across the Board

page.

For more information about Morningstar Sustainability RatingsTM, please visit our

Sustainability Ratings

page.

|

|

|

|

Sustainable competitive advantageWe look for companies with an economic moat, which creates a barrier to the competition and can potentially allow a company to produce high rates of return on their reinvestment of capital over longer periods of time. |

High returns on growth capitalGrowth capital is capital a company uses to grow its business versus simply maintain it. A high return on growth capital is an indication that a company is using capital efficiently and has the ability to create shareholder value over the long term. |

Secular growth opportunitiesA company must not only have a track record of growth, but be able to sustain it. We seek companies in industries that have steady tailwinds, which may help to maintain growth under broadly slowing economic conditions. |

* A full market cycle is defined as a period of bull, bear, and bull periods generally lasting four to five years.

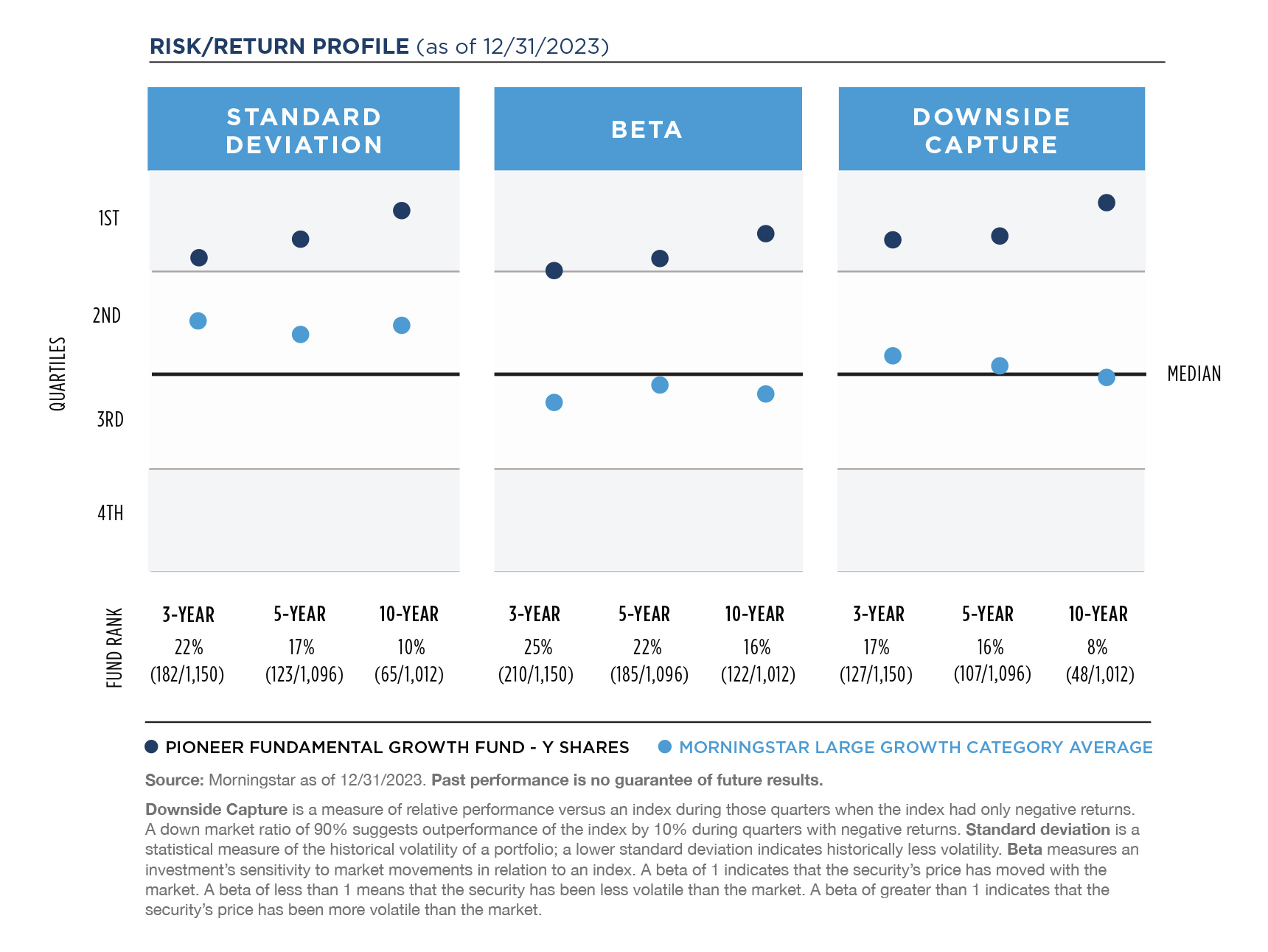

For growth investors who fear the effects of volatile markets, Pioneer Fundamental Growth Fund offers an attractive track record of risk and reward.

|

1-Year |

3-Year |

5-Year |

10-Year |

||

|---|---|---|---|---|---|---|

| Y Share | 33.12% |

9.37% |

17.48% |

13.27% |

||

| Russell 1000® Growth Index (Benchmark) | 42.68% |

8.86% |

19.50% |

14.86% |

||

| Morningstar Large Growth Category Average | 36.74% |

4.68% |

15.74% |

12.03% |

||

Gross expense ratio (Y): 0.76%.

Call 1-800-225-6292 or visit our performance page for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of investors, including institutional investors. Initial investments are subject to a $5 million investment minimum, which may be waived in some circumstances.

All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflects any applicable expense waivers in effect during the periods shown. Without such waivers, fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

Tickers, CUSIPs

Class A: PIGFX, 723695102 |

Investment ObjectiveLong-term capital growth Inception Date8/22/2002 |

BenchmarkRussell 1000® Growth Index |

Pioneer Fundamental Growth Fund's investment team seeks out high quality companies with distinctive characteristics, subjects them to intensive fundamental research and carefully values their stocks while focusing on a long-term investment horizon. The portfolio managers draw upon the research and investment management expertise of the research team, which provides fundamental and quantitative research on companies globally.

|

|

|

|

|

Andrew Acheson |

Yves Raymond |

David Chamberlain, CFA |

Matt Gormley |

A Word About Risk: Pioneer Fundamental Growth Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. The Fund may invest in fewer than 40 securities and, as a result, its performance may be more volatile than the performance of other funds holding more securities. Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

The Fund’s adviser may integrate ESG considerations in its investment research process, which may mean forgoing some investment opportunities available to funds that do not consider ESG information.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2024-10-25-ADID-3193168-1Y-T